The Select Board will be meeting tonight at 7pm in the Select Board meeting room at Town Hall. The board does not have a significant amount of agenda topics but the Tax Classification hearing is slated with a 1hr+ time-slot. Before that discussion though, the board will be introduced to the new Director of Equity & Social Justice, Albert Pless. Albert W. Pless, Jr., is an Adjunct Professor at the Tufts School of Medicine Online MPH program and a guest lecturer at the Tufts School of Community Health. He has over 25 years of experience working in community-based programs in the Greater Boston area. Previously, he was the Inaugural Director of Diversity, Equity, and Inclusion for the Town of Andover, Massachusetts.

In terms of the tax classification hearing, in 2021 the Select Board opted to retain the 1.02 tax classification shift rate for residential vs commercial properties for FY222 by a 5-0 vote. In 2022 though, the board opted for a commercial factor of 1.05 instead, shifting the burden onto commercial properties by a 3-2 vote for FY23. Board member Carlo Bacci pointed out that the savings for the average residential taxpayer would only be $15 a year while Karen Herrick wanted to see a slow shift towards 1.25. Using the 1.25 example for FY24, the increase to all commercial properties would be $1,346 while residents would still see an increase of $257, down from a potential $412 figure using last years 1.02 number. A residential difference of +$155.

During public comment at a prior board meeting, resident Angela Binda wanted to see the town move towards a 1.35 shift rate. Using the numbers in the packet as an example, the average commercial tax bill would go up by $2,286 while residential increases by $188. A residential difference of +$224. If the rates remained the same for FY24, the average commercial tax bill would decrease by $543 and residential would increase by $394.

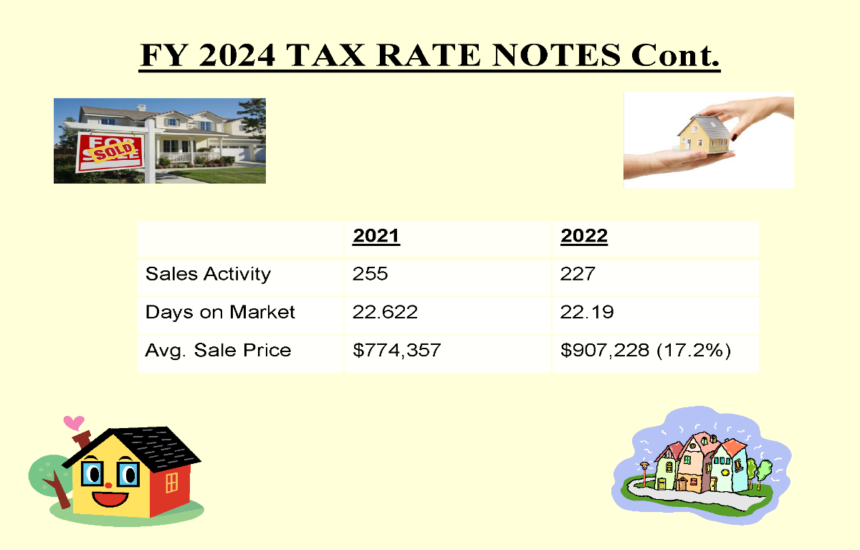

The reason why all of the residential taxes increase regardless of the shift to commercial? The average home sale price in Reading for 2022 ($907,228) increased by 17.2% compared to 2021 ($774,357) for a massive difference of $132,871 in one calendar year. Not even a maximum shift of 1.50 would result in a tax decrease for residential. As for taxing businesses separately in Massachusetts, you cannot ascribe a big box store a different rate than your local neighborhood business.

The complete agenda is listed below.

- 7:00 Overview of Meeting

- 7:05 Public Comment

- 7:15 SB Liaison & Town Manager Reports

- 7:30 Introduction of new Director of Equity

- 7:40 HEARING – Tax Classification

- 8:45 Discussion and Possible Vote on April 2024 Town Election

- 9:15 Select Board Appointment of Board of Registrars Member, in accordance with M.G.L. c. 51, s.20

- 9:30 Discussion on Town Manager Screening Committee and Search Process

- 10:00 Discuss Future Agendas

- 10:10 Approve Meeting Minutes

The 7PM meeting will take place in the Select Board meeting room at Town Hall. The public can attend in person or watch via several options: via a broadcast on RCTV’s YouTube channel at this link or on the RCTV Government Channel (Xfinity ch 22, Verizon ch 33). The Zoom link for this meeting is: https://us06web.zoom.us/j/87000187652